Estimated tax penalty calculator

Taxpayer failing to pay tax by the due date. 3 for overpayments 2 in the case of a corporation.

Strategies For Minimizing Estimated Tax Payments

Offer period March 1 25 2018 at participating offices only.

. Millions of people make quarterly estimated tax payments during the year in lieu of income tax withholding. Generally if you owe less than 1000 you do not have to pay quarterly estimated tax payments and will not see an estimated tax penalty. To avoid a penalty pay your correct estimated taxes on time.

Failure to Pay Tax Late Payment Penalty. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. The IRS may apply a penalty if you didnt pay enough estimated taxes for the year you didn.

Do You Need to Make Estimated Tax Payments. You may avoid the Underpayment of Estimated Tax by Individuals Penalty if. 90 of your tax for the current tax year.

IT-21051 Fill-in Instructions on form. Call it a prepayment. Check e-file status refund tracker.

Estimated Tax Payment Voucher for Individuals. In most cases to avoid a penalty you need to make estimated tax payments if you expect to owe 1000 or more in taxes for the yearover and above the amount withheld from your wages. The rates will be.

110 of your tax for the prior tax year including alternative minimum tax. To qualify tax return must be paid for and filed during this period. This estimated tax penalty calculator can be used by anyone to provide Form 2210 calculations.

2022 than you did in 2021 or end. If you pay at least 90 of your tax obligation or 100 of the tax owed in the prior year whichever is smaller then penalty can be avoided. To avoid a penalty you must pay on or before the below dates.

IRS interest rates will remain unchanged for the calendar quarter beginning April 1 2021. There are five ways to make estimated tax payments on your 1099 income. IRS Penalty Interest Rates.

May not be combined with other offers. Your filed tax return shows you owe less than 1000 or. The provided calculations do not constitute financial tax or legal advice.

Go to the same section of your 1040 where youd request your refund as a check or direct deposit. Visit our Tax Pro Center blog for additional professional tips and resource materials. That works out to 4273 in quarterly estimated taxes or 1424 if you want to pay monthly.

In the US federal income taxes are a pay-as-you-go system. Payment Amount Due date. Try Keepers free quarterly tax calculator to easily calculate your estimated payment for both State and Federal taxes.

Enter 100 of s income tax Check if s AGI was K. Penalty on early withdawal of savings. Do you have to apply the whole amount.

This penalty is equal to 005 of your tax due every month that it remains unpaid. If you use this method but end up earning more money in. WPRO-17 Enter an estimated deduction amount here and click EstimateStart with 10000 and click Estimate to adjust the deduction dollar amount until it matches or comes close to the amount in WPRO-12.

Individuals can also calculate their underpayment penalty with MassTaxConnects Estimated tax penalty calculator M-2210. You can also apply your tax overpayment to your next estimated tax bill. On line 36 theres an option to apply money to next years estimated tax.

Reconciliation of Estimated Tax Account for Individuals. Find how to figure and pay estimated taxes. Adding this estimated income tax to your self-employment tax of 9890 gives us the amount you should make in estimated payments over the course of the year.

Then you must base your estimated tax based on the lesser of. Generally most taxpayers will avoid this penalty if they either owe less than 1000 in tax after subtracting their withholding and refundable credits or if they paid withholding and estimated tax of at least 90 of the tax for the current year or 100 of the tax shown on the return for the prior year whichever is smaller. Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887-6367 or 800 392-6089 which is toll-free in Massachusetts.

Enter a high Deduction amount here and click Estimate until WPRO-17 below shows 0 or the same as in WPRO-12 see above. If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount. Payments due April 18 June 15 September 15 2022 and January 17 2023.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Underpayment of Estimated Tax Addition to Tax 19136 et seq 19142-19151. Alimony paid if deductible Traditional IRA deduction.

Calculate Your Estimated Income Tax Payments with Form 1040-ES so You Do Not Owe too Many Taxes. Estimated Tax Penalty Explained How to Avoid Penalty Tax Planning Save the Tax Dates. This means the IRS requires you to pay estimated taxes throughout the yeareither via withholding from paychecks or by making.

IT-21059 Fill-in IT-21059-I Instructions Underpayment of Estimated Tax By Individuals and Fiduciaries for tax year 2021. The provided calculations do not constitute financial tax or legal advice. By using this site you agree to the use of cookies.

This penalty is not imposed if for the same tax year the sum of Sections 19131 and 19133 penalties are equal to or greater than this penalty. To avoid the IRS underpayment penalty you can choose between the following approaches. Clear and reset calculator Print a taxpayer copy.

In some cases though the 1000 trigger point doesnt matter. Recommends that taxpayers consult with a tax professional. California differs from federal.

90 of estimated total tax 66 23 for farmers and fishermen 0. Learning about quarterly estimated tax payments is a rite of passage for any self-employed business owner.

The Complexities Of Calculating The Accuracy Related Penalty

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

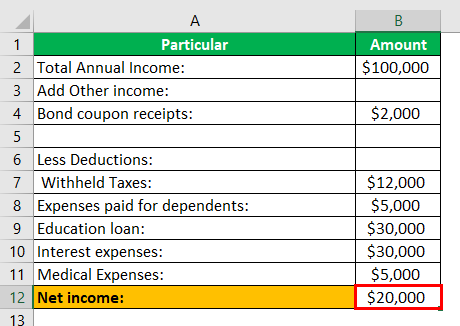

Excel Template Tax Liability Estimator Mba Excel

Estimated Tax Definition Calculation Examples Penalties

How To Calculate Estimated Taxes The Motley Fool

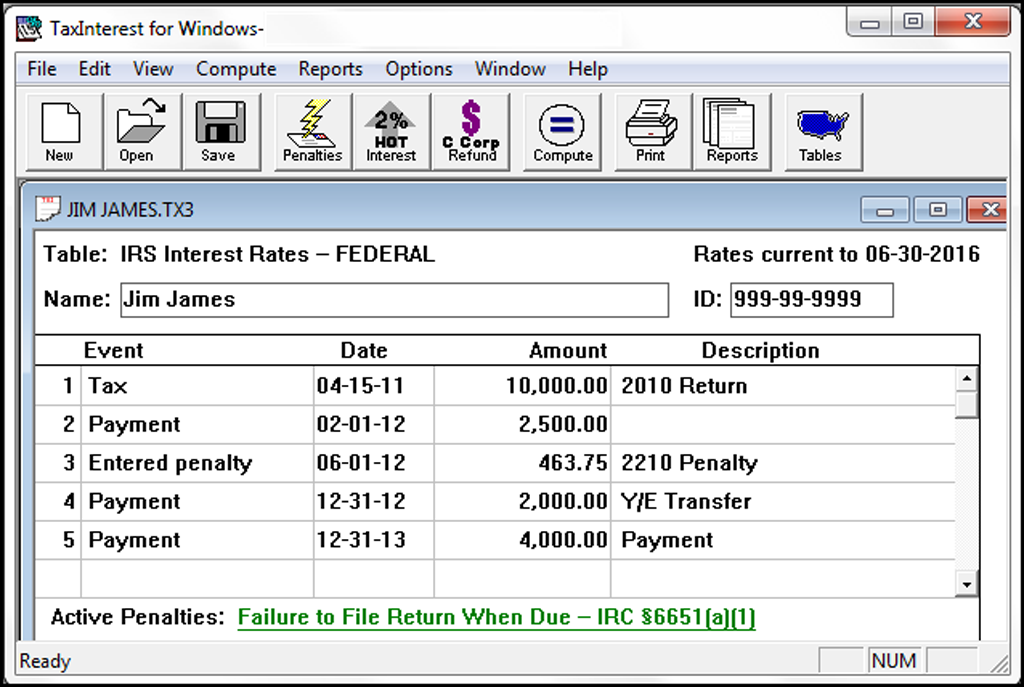

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Calculate Estimated Tax Penalties Easily

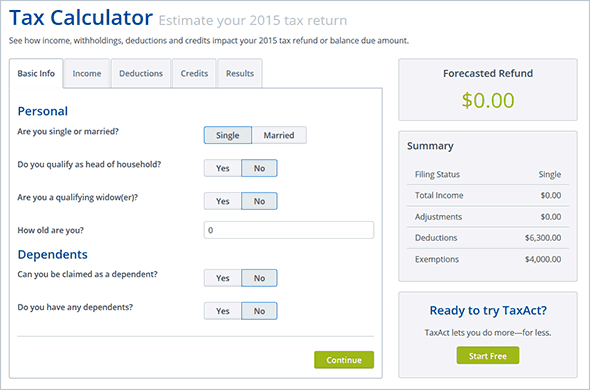

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

What Happens If You Miss A Quarterly Estimated Tax Payment

What Happens If You Miss A Quarterly Estimated Tax Payment